So, you’ve probably seen the “no spend challenge” trending on TikTok, right?

It might sound a bit intimidating at first, but trust me, it doesn’t have to be that hard.

Trying to save money is a struggle for me and it’s probably for you too.

When I saw this viral no spending challenge I thought, well that might be better than trying to save money…just don’t use it!

So, I tried it and it’s actually a fun way to save a little extra cash and learn to be frugal too.

The idea is simple: just cut out the non-essentials for a set period and see how much you can save. It’s not about being super strict or making life miserable.

It’s about finding creative ways to enjoy life without spending a ton.

And guess what?

You might even discover some cool, free stuff to do along the way!

Let’s get into how to make this challenge work for you without feeling like you’re giving up all the fun.

What is the No Spend Challenge?

The No Spend Challenge is pretty much what it sounds like – a break from spending money on anything that’s not absolutely necessary.

For us moms, it’s a chance to take a breather from the constant spending that comes with kids – like back to school – groceries, and all the little extras.

Instead of swiping the card for that extra coffee or the cute toy your kid spotted, the challenge is about holding back.

The idea isn’t to make life boring or restrictive but to become more mindful of where our money goes.

Think of it as a financial detox, giving your wallet a break and letting you see what you can do without.

You might find that the things you thought were needs are actually just wants.

For example, skipping the drive-thru coffee and making a fun, homemade version with the kids can turn into a fun family activity.

Or, instead of buying new clothes, you could try mixing and matching what you already have.

It’s about being creative and resourceful, all while keeping a little more cash in your pocket!

Here’s how you do it.

1. Set Your Rules

Every mom’s life is different, so the rules for your No Spend Challenge should fit your family’s needs. Start by deciding what’s off-limits.

Maybe it’s dining out, new clothes, or that tempting Target run.

Then, figure out what’s allowed.

Groceries and essentials like diapers and gas are usually okay, but you can set limits like sticking to a meal plan or buying generic brands.

If your kids have activities that require spending, decide if they fit into your challenge or if you can find free alternatives.

Here are some realistic rules you can set:

- No Dining Out: Cook meals at home, including lunches for work and school.

- No New Clothes: Use what’s in your wardrobe or swap with friends.

- No Non-Essential Groceries: Stick to a strict grocery list, avoiding snacks and treats.

- No Coffee Shop Visits: Make coffee at home instead.

- No New Toys or Games: Use what’s already available or swap with other families.

- No Entertainment Expenses: Opt for free activities like parks, library visits, or movie nights at home.

- No Impulse Purchases: Avoid buying items that aren’t planned or necessary.

- Limit Gas Use: Combine errands or use alternative transportation if possible.

- No Paid Subscriptions: Cancel or pause services like streaming or subscription boxes for the duration.

- Use Cash Only: Set a cash budget for essentials and leave credit/debit cards at home.

The key is to set realistic rules that challenge you without making you feel deprived. It’s also important to get the whole family on board, especially if the kids are old enough to understand.

This way, everyone knows what to expect, and you won’t have to explain why you’re skipping the usual Friday night pizza.

2. Choose a Time Frame

The next step is choosing how long you want to do the No Spend Challenge. This can be a week, a month, or even just a weekend.

For first-timers, a shorter time frame can make it easier to stick with it. Think of it as a test run.

A week is usually a good start, giving you enough time to see real savings without feeling like forever.

If you’re feeling confident, go for a month and really watch the savings pile up.

It’s all about finding a balance that works for your family and your comfort level.

For example, if you know your kid’s birthday is coming up, you might want to pick a different time.

A shorter challenge can still make a big impact, like planning no-cost activities for a weekend instead of a usual expensive outing.

Remember, the goal is to stretch yourself just enough to see a difference, not to set yourself up for failure.

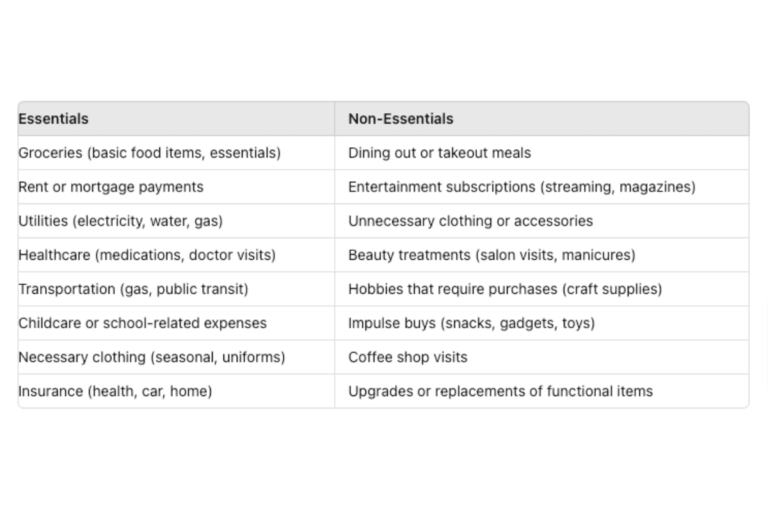

3. Identify Essential vs. Non-Essential Spending

One of the trickiest parts of the challenge is figuring out what counts as essential and what’s not.

Essentials are things like groceries, rent, and utilities. But even within those categories, there are choices. For groceries, it might mean sticking to a strict list and avoiding impulse buys.

For non-essentials, think about things you can live without, like that subscription box you rarely use or the morning coffee shop stop. For example, instead of buying snacks for the kids, you can try baking together at home.

It’s not just about cutting costs – it’s about rethinking habits. Maybe you’ve been picking up takeout because it feels easier, but cooking at home can be just as quick and a lot cheaper.

By being honest about what you really need versus what’s just a nice-to-have, you can save a surprising amount of money. And who knows, you might even find some joy in the simplicity!

4. Plan Free Activities

Keeping everyone entertained without spending money can seem daunting, but it’s actually a great chance to get creative.

Look for free activities in your community, like library story times, park days, or even a good old-fashioned movie night at home.

Instead of paying for a new board game, why not swap with another mom for the week?

You can also explore the great outdoors with nature hikes or beach days. For indoor fun, try a family cooking challenge or a DIY craft day with items you already have.

It’s all about thinking outside the box and seeing the value in simple pleasures.

For example, instead of buying tickets to a play, put on a family talent show. These moments can create lasting memories without the price tag.

Plus, it’s a great way to show the kids that fun doesn’t always have to cost money.

By planning ahead and keeping a list of free or low-cost activities, you’ll always have something to do without reaching for your wallet.

Here are some more ideas to get you started:

- Nature Walks: Explore local parks, trails, or beaches.

- Library Visits: Check out books, attend story time, or participate in craft sessions.

- DIY Craft Day: Use materials you already have at home for creative projects.

- Movie Night: Set up a cozy space at home and watch family movies.

- Picnics: Pack a lunch and head to a local park for a fun outdoor meal.

- Board Game Swap: Exchange games with another family for a fresh experience.

- Family Cooking Challenge: Cook a meal together using only ingredients on hand.

- Outdoor Games: Play soccer, tag, or have a frisbee toss in the backyard.

- Scavenger Hunt: Create a fun treasure hunt around the house or neighborhood.

- Talent Show: Let everyone showcase their unique skills and talents.

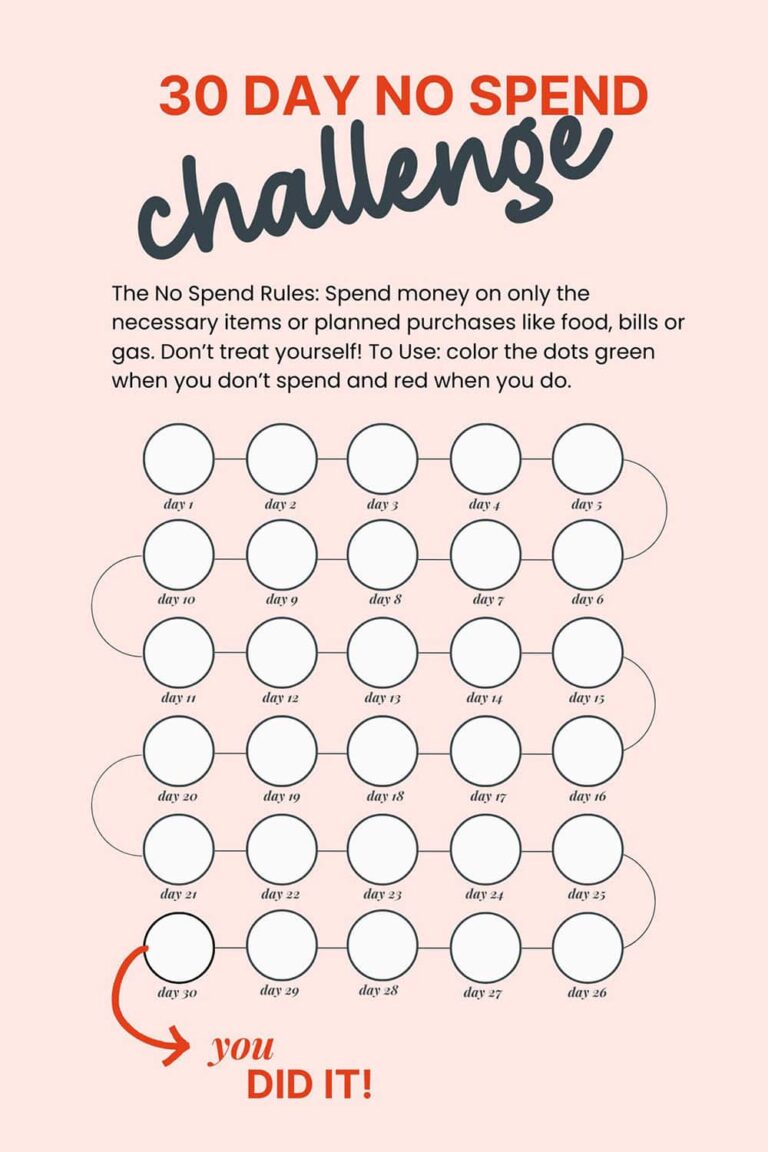

5. Track Your Progress

As you go through the challenge, keep track of your progress. This can be as simple as jotting down what you didn’t buy or how much you saved each day.

You can use a notebook, an app, or even a chart on the fridge.

Seeing the savings add up can be really motivating, especially when you compare it to your usual spending habits. It’s also a good way to reflect on your spending decisions and see where you can improve.

For instance, if you usually spend a lot on takeout, you might notice a big difference when you cook at home.

Tracking can also help you identify patterns, like when you’re most tempted to spend, and plan for those moments.

It’s not about being perfect but about making progress.

And at the end of the challenge, you can look back and see how much you’ve accomplished, which can be a big confidence booster!

6. Adjust as Needed

No plan is perfect, and the same goes for the No Spend Challenge. Life happens, and sometimes you need to adjust your rules.

Maybe an unexpected expense pops up, or you realize a rule isn’t working for your family.

That’s okay!

The goal is to stick to the challenge as much as possible, but it’s also important to be flexible.

So, if you planned not to eat out at all but have a family emergency, it’s okay to grab a quick meal. Adjust the challenge to fit your life, not the other way around.

If you slip up, don’t be too hard on yourself. Instead, learn from it and move on.

This is about building better habits, not about being perfect. By being adaptable, you can keep the challenge realistic and manageable, making it more likely to succeed in the long run.

7. Reflect on the Experience

At the end of the challenge, take some time to reflect on the experience. Think about what you learned, what worked, and what didn’t.

Did you find it easier or harder than you expected? What surprised you the most?

This is a great time to talk with your family about their thoughts and feelings.

Maybe the kids loved the homemade pizza nights and want to keep that as a new tradition.

Reflecting also helps you see the value of the challenge beyond just saving money. It’s about changing your mindset and finding joy in the little things.

Maybe you discovered a new hobby or realized how much you appreciate the simple pleasures in life. Use these reflections to set new financial goals or make adjustments to your spending habits.

The No Spend Challenge isn’t just a one-time thing; it’s a stepping stone to a more mindful and intentional way of living.

So…Should You Try the Viral No Spend Challenge?

Absolutely!

The No Spend Challenge is a great way to reset your spending habits and gain a better understanding of your finances. It’s not just about saving money; it’s about finding contentment in what you already have and making mindful choices.

Even if you’re skeptical, trying the challenge for a short period can be eye-opening.

You might discover that many of your purchases are more about convenience than necessity.

Plus, it’s a fun way to get the whole family involved in budgeting and planning.

The challenge can also spark creativity, pushing you to find new, free activities and make the most of your resources.

And remember, it doesn’t have to be perfect or extreme. It’s about progress, not perfection.

So, if you’re curious or just looking for a new way to save, give it a shot.

You’ll be surprised at how much you enjoy it and the savings you rack up!

Make sure to follow me on Pinterest for more budget friendly ideas for your family!