As a busy mom, I know firsthand how overwhelming managing finances and sticking to a budget can feel.

Between the endless grocery runs, school supplies, and those inevitable unexpected expenses that always seem to pop up, it’s easy to feel like you’re constantly playing catch-up.

And let’s be real—it often seems like there’s just never enough left at the end of the month, no matter how carefully we plan.

That’s why I’ve made it my mission to find simple and effective money-saving strategies that really work.

And I want to share some of my favorite tips and tricks that have helped me cut costs and stretch my budget.

Trust me, if I can do it, so can you!

Let’s tackle our finances together and make room for the things that truly matter in our lives.

Best Budgeting Tips for Families Struggling

When every dollar counts, finding ways to budget wisely can relieve stress and bring more control over family finances.

These tips help families prioritize essentials, cut back on non-essentials, and stretch every dollar a little further.

With small adjustments, it’s possible to build stability, even when finances feel tight.

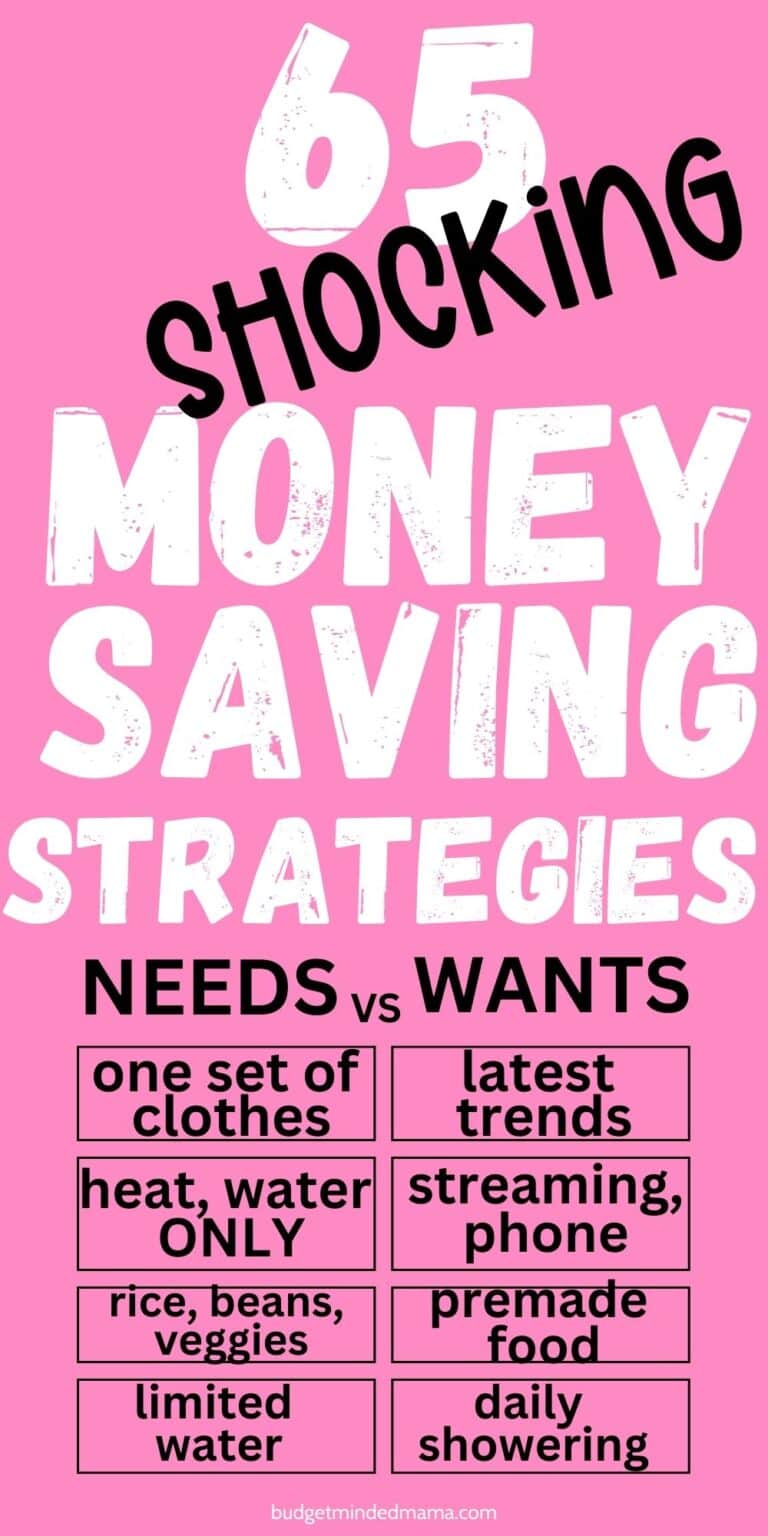

1. Set Up a “Needs vs. Wants” List

When money is tight, distinguishing between needs and wants is essential.

By listing out what’s necessary and what’s nice to have, we can make clear decisions on where to spend.

It helps everyone in the family understand priorities, and it can actually be eye-opening to see how much we spend on things that aren’t true essentials.

2. Create a Weekly Meal Plan Based on Sales

Each week, I like to check grocery store flyers and plan meals around what’s on sale.

It not only keeps my budget in check but also encourages us to try new recipes based on seasonal items.

Plus, having a plan makes grocery shopping faster and more organized.

3. Limit Takeout to Once a Month

Takeout can add up quickly, so I limit it to a special treat once a month.

By cooking at home and planning meals, I can save a significant amount while enjoying healthier, home-cooked dishes.

This strategy also helps us appreciate takeout more when we do decide to splurge.

4. Use Cash for Discretionary Spending

Setting aside a certain amount of cash for non-essential purchases helps prevent overspending.

I physically see the money disappearing, which makes me more cautious about each purchase.

When the cash is gone, it’s a clear signal to pause any extra spending.

5. Negotiate Bills for Lower Rates

You’d be surprised at how much you can save just by calling and asking for lower rates on your bills.

Companies often have discounts or loyalty programs that aren’t advertised.

I make it a point to review bills every few months and ask about available discounts.

6. Switch to Generic Brands

Switching to generic brands is one of the easiest ways to save without sacrificing quality.

For many products, the ingredients are nearly identical, and the savings can add up fast.

I like to try the store-brand version of products, and if we like it, we make the switch permanently.

7. Automate Bill Payments to Avoid Late Fees

Late fees can add up quickly, so automating payments for regular bills is a lifesaver.

Setting up autopay ensures we never miss a due date, which also helps improve credit over time.

This little step brings peace of mind and keeps our finances on track.

8. Try a “No-Spend” Week Each Month

Once a month, I like to challenge myself and my family to a “no-spend” week, where we focus on using up what we already have.

It makes us more mindful of our spending habits and resourceful with our pantry items.

By the end of the week, we’ve usually saved a bit and reduced clutter too.

9. Shop Secondhand for Clothes

Secondhand stores are fantastic for finding quality clothes at a fraction of the cost.

I especially love shopping for kids’ clothes secondhand since they outgrow things so quickly.

It’s also environmentally friendly and can lead to some unique, fun finds.

10. Buy Essentials in Bulk

For items we go through regularly, like toilet paper and cleaning supplies, buying in bulk saves money and minimizes trips to the store.

It’s a simple way to reduce costs per unit, especially if you have storage space.

I find that bulk purchases give us a good cushion during tight months.

11. Limit Subscriptions or Use Free Alternatives

Subscriptions add up faster than we think, so I keep only the ones we truly use.

I like to assess every few months to see if we’re still benefiting from them or if we can swap to a free version.

Cutting back on streaming or magazines can save us more than expected.

12. Involve Older Kids in Budgeting

When older kids understand the family’s budget, they’re often more willing to help save.

I talk to my kids about making smart choices and sometimes let them help with grocery budgeting.

It teaches them valuable life skills and brings us closer as a family working toward a common goal.

13. Downsize Housing if Possible

Housing costs are one of the biggest expenses, so downsizing can be a huge help.

If moving to a smaller space is an option, it can free up money for other priorities.

Sometimes even adjusting utility usage in a smaller home brings savings over time.

14. Meal Prep on Weekends

Preparing meals in advance on weekends helps us avoid buying convenience foods.

It saves time during busy weeks and keeps us from reaching for takeout.

I’ve noticed that having meals prepped reduces stress and makes healthy eating easier, too.

15. Check for Community Resources

Many communities have resources that help families save, like food banks or school programs.

I always keep an eye out for any local assistance that can ease our budget.

Using these resources can make a huge difference during tough financial months.

16. Cancel Unused Memberships

Gym and club memberships can go unnoticed on the bank statement, so I periodically review them.

If there are any we’re not actively using, they get canceled right away.

It’s an easy way to reclaim money that can be better spent elsewhere.

17. Use Energy-Saving Practices

Simple energy-saving habits, like turning off lights and unplugging electronics, can lower utility bills.

I like to make it a game for the family to see how low we can keep the electric bill.

Small adjustments add up and keep the budget lean without much effort.

18. Set Up a Family Emergency Fund

Having a small emergency fund gives us peace of mind and a safety net.

I started by setting aside just a little each paycheck, and it’s grown over time.

This fund has been a lifesaver for unexpected expenses like car repairs.

19. Keep a Budget Binder for Tracking

Using a budget binder helps me track all expenses and keep everything organized.

I jot down every purchase, which makes it easier to see where we could save.

Reviewing it at the end of each month shows me trends and areas for improvement.

20. Sell Unused Items Locally

Decluttering and selling unused items online or at yard sales brings in extra cash.

I involve the kids in picking out toys or clothes they’ve outgrown, which also keeps our space tidier.

Selling these items helps us earn back a little and feel less wasteful.

21. DIY Gifts and Cards

Making gifts and cards ourselves saves money and adds a personal touch.

I find that the kids love getting creative, and our DIY gifts are often more meaningful.

It’s also a great way to cut costs around the holidays or special occasions.

22. Start a Small Vegetable Garden

Growing a few vegetables at home helps cut grocery costs and provides fresh ingredients for some yummy poverty meals.

I started with easy plants like tomatoes and herbs, and they make such a difference.

It’s a fun family activity and brings a sense of accomplishment, too.

23. Rotate Toys and Books

Instead of buying new toys, I rotate the ones we already have to keep things fresh.

Kids often rediscover excitement for toys they haven’t seen in a while.

This trick keeps them entertained without spending extra money.

24. Switch to Cloth Diapers

If you’re open to it, cloth diapers can save a lot over time compared to disposables.

The initial investment is higher, but it pays off quickly with the savings on diaper purchases.

I found it also reduced our household waste, which felt like an added bonus.

25. Join Local Buy-Nothing Groups

These groups are perfect for exchanging items for free with people in your community.

I’ve gotten everything from clothes to kitchen gadgets without spending a dime.

It’s also nice to connect with others locally who are on a similar budget journey.

Biweekly Savings Plan for Low-Income Families

Saving on a low income isn’t easy, but a biweekly approach can make it more manageable.

This plan focuses on small, achievable steps that build savings every payday, allowing families to see progress without feeling overwhelmed.

With simple biweekly habits, you’ll gain a bit of breathing room and financial security over time.

26. Save a Small Amount Each Payday

Even setting aside $5 or $10 from each paycheck can build up over time.

I like to transfer this small amount to savings as soon as I get paid.

Over months, it grows into a helpful cushion for future needs.

27. “Pay Yourself First” Strategy

Setting aside a little for savings before spending on anything else is a habit I’ve embraced.

This approach makes sure that we’re always building up savings, even if it’s a small amount.

It’s a way of prioritizing ourselves and our future goals.

28. Save Biweekly “Leftovers” by Rounding Down

At the end of each pay period, I round down our checking account to the nearest $10 and move the extra to savings.

It’s a fun little game and adds up without us even feeling it.

I like seeing these small amounts accumulate over time.

29. Use a Biweekly Grocery List

Sticking to a list based on pay periods keeps grocery spending predictable.

I avoid unnecessary shopping trips by planning for the full two weeks.

It’s a straightforward way to stay within budget and prevents impulse buys.

30. Make a Biweekly Meal Plan

Planning meals biweekly means fewer trips to the store and less temptation to overspend.

I love that it lets me be more organized and intentional with our groceries.

This habit has saved us time and money, especially during busy periods.

31. Try a Biweekly Savings Challenge

Every other paycheck, I challenge myself to save a little more than the last one.

It’s a fun, achievable way to increase savings gradually.

I enjoy seeing the progress without feeling pressured.

32. Set a Biweekly “Fun Money” Budget

Allocating a specific amount for fun every two weeks prevents overspending.

I feel better knowing that we have room to enjoy ourselves without it affecting our essentials.

This way, we get a little treat while staying on track with our budget.

33. Round Up Purchases to Save the Difference

Each time I make a purchase, I round up to the nearest dollar and transfer the difference to savings.

This simple method helps us save little by little without even noticing.

Over time, it’s surprising how quickly these small amounts add up.

34. Use Separate Accounts for Bills and Savings

Dividing our money into separate accounts makes it easier to keep track of bills, savings, and spending.

I like knowing that what’s in the “bills” account is strictly for expenses, so I don’t overspend elsewhere.

This approach gives us a clearer view of our finances and prevents accidental spending.

35. Limit Spending to Specific Days Each Pay Period

Choosing a few days per pay period to handle shopping and errands helps control our spending.

I only buy essentials outside of those days if absolutely necessary.

It keeps us mindful of every dollar and reduces the urge for unnecessary purchases.

36. Set Up Biweekly Auto Transfers to Savings

I have a small, automatic transfer set up every payday to move funds to savings.

This way, saving is done without even thinking about it.

I find it’s easier to stay consistent with this automated system.

37. Use a Biweekly “Wish List” for Purchases

When I want something that isn’t essential, I add it to a wish list instead of buying it right away.

Every two weeks, I review the list and decide if I still want those items.

Often, I’ve found that the initial urge fades, which saves money on impulse buys.

38. Only Shop Every Other Week

By limiting shopping trips to every other week, I reduce the chances of making impulse purchases and unnecessary items.

This approach forces me to plan better and avoid the temptation to spend more frequently.

Plus, fewer shopping trips mean we’re using up what we have at home.

39. Evaluate Recurring Expenses Biweekly

Every other payday, I review all subscriptions and memberships to see if they’re still worth it.

If there’s anything we haven’t used or can go without, it gets canceled.

It’s a great habit that frees up extra cash for more important needs.

40. Use a Biweekly Envelope System

I keep a set amount of cash in envelopes for each spending category every two weeks.

Once the envelope is empty, I know we’ve hit our limit in that area.

This physical method of budgeting is a helpful reminder to stick to our goals.

41. Track Spending Patterns Biweekly

Reviewing expenses every two weeks helps me spot spending patterns that could be improved.

It’s easier to stay on top of our budget when I address things early.

This habit has helped me adjust and save more effectively.

42. Plan a “Leftover Week” Each Pay Period

Designating a “leftover week” helps us use up everything we have before shopping again.

I enjoy finding creative ways to turn leftovers into new meals, which prevents waste.

This strategy also stretches our grocery budget and makes each trip count.

43. Set Biweekly Savings Goals

I set small savings goals every two weeks to keep our momentum going.

It’s a manageable way to make progress without feeling overwhelmed.

These short-term goals are satisfying to reach and help build our savings steadily.

44. Buy in Bulk with Each Paycheck

I use part of each paycheck to buy items in bulk that we use often.

It means fewer trips to the store and lower costs per item in the long run.

Plus, stocking up helps us feel more secure knowing we have essentials on hand.

45. Save Spare Change After Each Bill Payment

After paying bills, I transfer any leftover change to our savings account.

This little action adds up without impacting our spending power too much.

I’ve noticed that it builds a nice buffer over time with minimal effort.

46. Try a Cash-Only Biweekly Strategy

For discretionary spending, I withdraw a set amount of cash every other week.

When the cash runs out, I know it’s time to stop spending in that area.

This approach keeps us disciplined and makes budgeting feel more tangible.

47. Meal Prep Biweekly to Cut Grocery Costs

Prepping meals every two weeks based on our grocery haul keeps us from running back to the store.

It saves time and reduces the temptation of buying extra items mid-pay period.

This practice also helps us avoid the extra costs of convenience foods.

48. Make a Biweekly “Needs vs. Wants” List

I take a few minutes each payday to write down needs and wants for the next two weeks.

This list keeps us focused on what’s truly important and helps us resist unnecessary spending.

By sticking to the “needs” list, we’re able to save more.

49. Divide Savings Goals into Biweekly Contributions

Breaking down big savings goals into biweekly chunks makes them feel more achievable.

Instead of stressing over a huge target, I just focus on meeting my biweekly amount.

This method keeps us motivated and on track without feeling overwhelmed.

50. Use a Biweekly “Saving Challenge” Jar

I keep a jar and add a few dollars to it every other week as part of a personal challenge.

It’s a fun way to save and see how much I can add each pay period.

Over time, this jar has helped fund little family treats and emergencies.

Budgeting Money Advice That Weathers Tough Times

When money is tight, having strategies that stand the test of hard times can make a world of difference.

These budgeting tips focus on essential needs, reduce non-essentials, and help you stay steady through financial ups and downs.

With these approaches, families can keep control and stability, even in uncertain times.

51. Create a Bare-Bones Budget for Tough Months

A bare-bones budget focuses only on absolute necessities, leaving out non-essentials.

I use this type of budget when we know finances will be tighter, helping us conserve every dollar.

This lean approach is handy when unexpected expenses arise.

52. Keep a Buffer Fund in Your Checking Account

Having a small buffer in our checking account gives us peace of mind in case of unexpected expenses.

This extra amount keeps us from dipping into savings or stressing over overdrafts.

It’s a small cushion, but it makes a big difference in managing tight budgets.

53. Reevaluate Non-Essential Spending Quarterly

Every three months, I go through our non-essential spending to see where we can cut back.

This periodic review keeps our budget in check and prevents wasteful habits from sneaking in.

It’s surprising how much extra we save with regular reviews.

54. Stick to a Spending Plan

A spending plan helps me allocate specific amounts for each category based on our priorities – like a gift budget for birthdays.

I review it every few days to make sure we’re sticking to our goals.

It’s a great way to prevent overspending and make every dollar count.

55. Prioritize Paying Off High-Interest Debt

Paying off high-interest debt first frees up more money for our budget over time.

I focus on these debts with any extra funds to reduce the amount we lose to interest.

This strategy has made a noticeable impact on our monthly expenses.

56. Use Digital Budgeting Tools

I like using budgeting apps to track our spending in real time.

They make it easy to spot where our money goes and adjust as needed.

This digital approach helps me stay on top of our finances without keeping too many receipts.

57. Build an Income Replacement Fund

Setting aside a small amount every paycheck toward an income replacement fund has given us a safety net.

It’s meant to cover basic expenses if income dips, offering us a little security.

I feel better knowing we have something to fall back on.

58. Rotate Meals Based on Staples

I plan meals around staple foods like rice, pasta, and beans, especially during tighter months.

This approach keeps costs low and ensures we’re always using up what we have.

By focusing on staples, we get creative with meals without overspending.

59. Invest in Reusable Items to Cut Recurring Costs

Buying reusable items like cloth napkins, food containers, and filters reduces our need to buy disposables.

It’s an upfront investment that pays off with savings on recurring costs.

I appreciate that it’s also better for the environment.

60. Bundle Insurance Policies

Bundling home, auto, or renter’s insurance policies can often lead to a lower overall rate.

I like to check with our provider to see if there are any available discounts for bundling.

This approach has saved us quite a bit each year on premiums.

61. Focus on Needs-Based Budgeting

During tough times, focusing on needs rather than wants helps us stretch every dollar.

I make sure essentials like housing, food, and utilities are covered before anything else.

This mindset keeps our budget realistic and manageable.

62. Reevaluate Your Budget Monthly

At the end of each month, I review our budget to see what worked and what didn’t.

This regular check-in helps us make adjustments and avoid recurring issues.

Monthly reviews give us a fresh start and keep us on track.

63. Stick to a Paycheck-to-Paycheck Calendar

I organize our budget around each payday to ensure we’re meeting expenses without overspending.

This approach helps me allocate funds for bills, groceries, and savings right when money comes in.

It keeps us organized and helps avoid shortfalls.

64. Limit Recreation to Free Options

Instead of spending on entertainment, I seek out free activities like parks, hikes, or library visits.

It’s a great way to enjoy time together without affecting our budget.

I find we appreciate these moments more when they’re simple and low-cost.

65. Use Digital Coupons and Cashback Apps

I regularly check for digital coupons and cashback opportunities before making purchases.

These small savings add up quickly and help stretch our budget.

It’s an easy habit to build and keeps a little extra in our pockets.

Finding Stability in Your Family’s Finances

No matter the challenges, it’s possible to create a more stable financial future with the right budgeting habits.

From small savings steps to strategic spending adjustments, every little bit can help your family feel more in control.

With consistency and focus, these tips can make a real difference in building security and managing life’s ups and downs!