When I first started trying to figure out how to stick to my budget, I thought it would be as easy as just cutting out the little extras here and there.

But I quickly realized it was harder than I thought.

The weekly coffee trips, spontaneous purchases, and last-minute grocery splurges all added up.

I remember one month when I had big plans to save and really start a budget that works, but by the end of it, my bank account didn’t look much different.

That’s when I decided to try to budget better and stick to it!

Through trial and error, I figured out some simple budgeting methods that made a huge difference in how I managed our money—and I’ve stuck to them ever since.

If you’re wondering how to stick to your budget, too, then these easy steps might just make all the difference for you like they did for me!

How to Create a Budget and Stick to It

Creating a budget involves understanding your financial situation and setting realistic limits based on your income and expenses.

And this is more important when you are living on one income like I am.

It’s important to keep things simple, focusing on key areas like bills, savings, and daily expenses, to avoid feeling overwhelmed.

With the right approach, a budget can help manage money effectively while still allowing for occasional flexibility.

1. Track All Of Your Expenses

The first step to sticking to a budget is knowing exactly where your money is going.

I started by writing down every dollar I spent for a week, and it was an eye-opener.

Tracking all your expenses might feel overwhelming at first, but it’s one of the most important habits to develop.

Start by writing down every dollar you spend for at least a week, whether it’s a large bill or a small snack.

This helps to reveal patterns that may have gone unnoticed—things like multiple coffee runs or spontaneous online buys.

By seeing everything in black and white, it becomes much easier to identify areas where spending can be cut back or redirected toward more important needs.

It’s like laying a foundation for financial control.

2. Prioritize Needs Over Wants

It can be tempting to spend on things that bring short-term joy, but focusing on what’s really needed is the backbone of any solid budget.

Groceries, housing, utilities, and the kids’ essentials (back to school) should always come first, while those extra splurges like new clothes, takeout meals, or that shiny new gadget can wait.

This doesn’t mean eliminating wants altogether, but it does mean making sure the necessities are covered first.

This mindset helps you make better choices when tempted to spend on something that isn’t really needed.

It’s about striking a balance between being responsible and enjoying the extras when the budget allows for it.

3. Use a Simple System

When I first tried budgeting, I made the mistake of overcomplicating it with spreadsheets and categories I didn’t even need.

I soon realized that keeping it simple worked best for our family – a budget doesn’t have to be complicated to be effective.

One of the easiest ways to stay on track is to use a simple system.

Overcomplicating things with too many categories or detailed spreadsheets can lead to frustration and make the process feel overwhelming.

Instead, break it down into just a few key categories like bills, savings, and spending money.

This way, it’s easier to see where the money is going without getting bogged down in too many details.

A straightforward approach keeps things manageable, making it more likely that the budget will stick long-term.

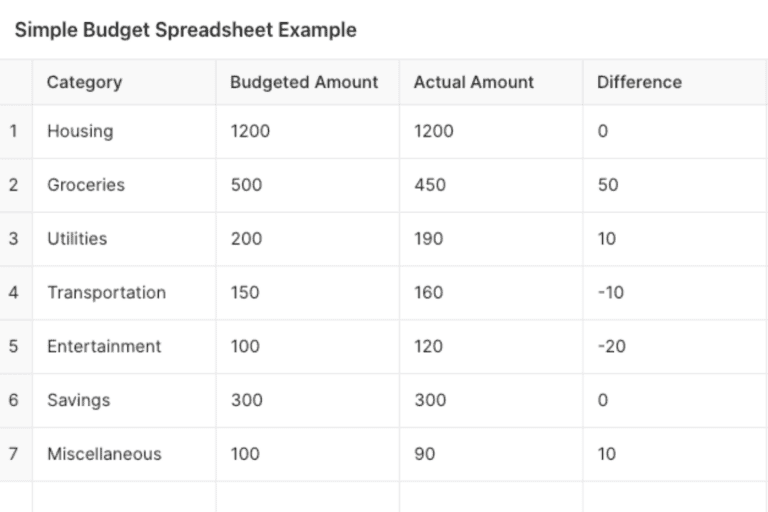

Here’s an example of a super simple spreadsheet:

4. Use Visuals

Visual tools can be incredibly helpful for keeping a budget on track.

Whether it’s a chart, graph, or even a colorful whiteboard on the fridge, having a visual representation of your spending can make it easier to stay motivated.

Seeing your progress, such as debt going down or savings going up, can give you that extra boost to keep going.

Visuals also make it easier to communicate the budget with the rest of the family, turning financial goals into something everyone can see and work toward.

Plus, it makes reviewing the budget each month feel more engaging and less like a chore.

5. Set Up Automatic Transfers

One of the best ways to stick to a budget without having to think too much about it is to automate savings and bill payments.

Setting up automatic transfers means money gets moved to savings or toward bills right when income comes in, leaving less temptation to spend it elsewhere.

By automating these transactions, there’s no need to manually make those transfers each month, reducing the risk of forgetting or putting it off.

It’s a hands-off method that makes budgeting easier and keeps savings goals on track without constant effort!

6. Use the Envelope System

The envelope system is a time-tested way to control spending, especially in areas where it’s easy to go over budget.

For each spending category—like groceries, entertainment, or gas—set aside a specific amount of cash and place it in a labeled envelope.

When the envelope is empty, spending in that category stops for the rest of the month.

This method can be incredibly effective because it adds a physical limit to spending, making it harder to overspend on things that aren’t necessary.

It’s a simple, no-nonsense way to stick to a budget without needing complicated tools or apps.

7. Review Your Budget Every Month

Budgets are not something that can be set once and forgotten.

Regularly reviewing the budget each month is a great way to make sure it’s still working for you.

Life is always changing—unexpected expenses come up, income can fluctuate, or priorities may shift.

By taking time each month to check in, it becomes easier to adjust and make changes where necessary.

This monthly review helps keep things on track and ensures the budget continues to reflect your current financial situation.

It’s a small habit that can make a big difference over time.

How to Stick to a Budget: Tips that Work

Sticking to a budget requires both discipline and balance, but it doesn’t have to feel restrictive.

Planning ahead, setting achievable financial goals, and getting the family involved can make the process smoother.

A budget that allows for occasional rewards and adjusts to life’s changes is easier to follow long-term.

8. Plan for the Unexpected

I’ve learned that life loves throwing curveballs, and not planning for them can wreak havoc on a budget.

Make sure there’s a small fund for those unexpected expenses, whether it’s a car repair or a sudden doctor’s visit.

By setting aside even a small amount, these surprises won’t completely derail the plan. It’s better to be prepared than caught off guard.

9. Set Small and Realistic Goals

It’s tempting to aim for big financial goals, but breaking them into smaller steps makes them more manageable.

Focus on achievable milestones, like cutting back on takeout for one week or saving a set amount by the end of the month.

These little victories add up and keep motivation high!

The key is to set yourself up for success by making goals realistic.

10. Get the Family on Board

Budgeting is so much easier when everyone in the household works together.

Talk to your family about spending limits and financial goals, and make it a group effort.

Whether it’s cutting back on snacks or saving for a family outing, when everyone is involved, it feels less like a chore.

In the end, it’s all about teamwork and shared responsibility.

11. Avoid Impulse Buys (24-Hour Rule)

I used to be guilty of impulse shopping, especially when something caught my eye on sale.

Now, I use the 24-hour rule: if I want to buy something that isn’t a necessity, I wait a full day before deciding.

This is especially good for then you have to buy gifts for a birthday.

Most of the time, that urge fades, and I realize I didn’t need it after all.

This simple trick has saved me a lot of money and regret.

12. Keep It Flexible

Budgeting shouldn’t feel restrictive.

While it’s important to stick to your plan, allow for some flexibility, especially when something fun or unexpected comes up.

A little wiggle room makes budgeting sustainable and less stressful.

After all, the goal is to create a balance between saving and enjoying life.

13. Forgive Yourself

Nobody’s perfect, and budgeting can come with slip-ups.

Maybe there was an unplanned expense or an overspend on groceries—whatever the case, don’t beat yourself up.

Acknowledge the mistake and get back on track without guilt.

Being kind to yourself is just as important as sticking to the budget!

14. But Also Reward Yourself

Sticking to a budget takes discipline, and rewarding yourself for doing well can keep you motivated.

Treat yourself to something small, like a coffee or a favorite snack, when you hit a savings goal.

Rewards don’t need to be expensive but should feel like a little celebration for staying on track.

It helps turn budgeting into a positive experience.

How to Stick to a Grocery Budget

Managing grocery costs is one of the easiest ways to stick to a budget, especially with some smart strategies in place.

Planning meals, shopping sales, and buying in bulk can significantly reduce spending without sacrificing quality.

Sticking to a weekly grocery list and avoiding impulse buys helps keep spending in check while ensuring the household is well-fed.

15. Meal Planning

Planning meals ahead of time takes the guesswork out of shopping and helps prevent overspending. Knowing exactly what’s needed for the week helps avoid buying unnecessary extras. It also cuts down on midweek grocery runs that can lead to impulse buys.

16. Shop Sales and Use Coupons

Keeping an eye on sales or using coupons can stretch the grocery budget a little further. It’s worth checking out weekly flyers or apps to see what deals are available. Combining sales with meal planning makes it easy to save on essentials.

17. Check Out Money-Saving Apps

Money-saving apps like Flipp or Checkout 51 are great for finding deals and rebates on groceries. They can be used to compare prices across stores or even earn cashback on purchases. It’s an easy way to save without much effort.

18. Buy in Bulk (When It Makes Sense)

Buying in bulk can lead to big savings, especially for pantry staples or household items that get used regularly. But it’s important to make sure bulk purchases are actually being used. Sticking to items that won’t go to waste is the key to saving money.

19. Buy Seasonal Produce

Seasonal produce is usually fresher and cheaper than out-of-season fruits and veggies. Focusing on what’s in season can make a big difference in the grocery bill. It also gives a chance to try new recipes based on what’s available.

20. Make Things From Scratch

Pre-packaged and processed foods often cost more than homemade versions. Simple meals like soups, sauces, or even snacks can be made from scratch at a fraction of the cost. It’s not only budget-friendly but healthier too!

21. Prep Freezer Meals

Preparing meals in bulk and freezing them for later can save both time and money. It’s perfect for busy nights when takeout might seem like the easiest option. Freezer meals help avoid the temptation to overspend on convenience foods.

22. Stick to One Grocery Trip Per Week

The more often a grocery store is visited, the more tempting it is to overspend. Sticking to one grocery trip per week helps limit those unnecessary extras that tend to sneak into the cart. It’s a small change that can make a big difference.

23. Don’t Shop Hungry

Shopping on an empty stomach almost always leads to impulse buys. It’s easier to stick to the grocery list when hunger isn’t clouding your judgment. Eating a snack before heading to the store helps keep spending in check.

You Can Stick To Your Budget!

Sticking to a budget doesn’t have to be overwhelming or restrictive.

With simple methods, a bit of tracking, and the right mindset, managing your finances can become second nature.

The key is finding a system that works for you and your family, staying flexible, and celebrating the small wins along the way!

For more help on budgeting, follow me on Pinterest!