Creating a financial stability vision board is one of those activities that might sound a little out there at first, but trust me, it’s totally worth it.

If you’re like me, sometimes it feels like there are a million things to juggle – bills, savings goals, debt, and all that financial stuff.

But the idea behind a vision board is simple: it’s all about visualizing your financial goals and dreams in a way that keeps you motivated.

I’ve found that having a visual reminder really helps me stay focused on what I want to achieve.

And it doesn’t have to be perfect – it just needs to inspire you!

Think of it as your personal financial roadmap, with financial quotes and vision board examples to get the creative ideas flowing.

So, let’s dive in and make that vision of financial freedom come to life!

Pics for a Vision Board (2025 Edition)

Use images of things you’re saving for—like a new home, travel destinations, or a healthy emergency fund.

It’s all about creating a visual representation of your goals, so make sure to include what lights you up and gets you excited for the future!

Financial Goals

You can start with images of your financial goals, like pictures of your dream home, the vacation you’ve always wanted, or that car you’re saving up for.

Seeing these images can really help keep you focused on what you’re working toward.

Set a goal to save for a down payment on your house or that bucket-list trip, and break it down into smaller, manageable steps to make it feel more achievable.

Debt-Free Living

You can use your financial stability vision board for visualizing a debt-free life.

You could use images of credit cards with “zero balance” stickers or someone crossing off a debt from a list.

Setting a goal to pay off credit cards, student loans, or any other debt by a specific date will make the whole process feel more concrete and doable.

Savings & Investments

For savings and investments, you could add pictures of growing savings accounts, investment portfolios, or simply a stack of cash.

A good goal here is to build up an emergency fund or start contributing more consistently to your retirement.

Just seeing that progress can really give you the motivation to keep going.

Financial Freedom

If financial freedom is what you’re after, add images that represent that vision, like relaxing on a beach or spending time with family without the worry of money hanging over your head.

This is where setting goals around paying off your debts, creating passive income, or cutting down your monthly expenses comes into play.

It’ll make your freedom feel like it’s just around the corner.

Budgeting

Budgeting visuals are helpful as well.

You could add pictures of an organized budget planner or a simple spreadsheet.

A great goal to set here is sticking to your budget for the month, tracking all your spending, or cutting down on unnecessary expenses.

Learning & Growth

make sure to include images that represent learning and growing in your financial journey.

Maybe pictures of books, financial podcasts, or someone taking an online class.

Set a goal to read at least one personal finance book every couple of months or complete a course to really level up your knowledge and take control of your money.

Lifestyle Changes

Lifestyle changes can be a huge part of getting your financial situation in check, and visuals for this can really help keep you on track.

You might add pictures of things you want to cut back on, like dining out or impulse shopping, to remind yourself of the habits you’re working to change.

Setting goals around these changes could be as simple as limiting your takeout to once a week or cutting back on unnecessary subscriptions that eat into your budget.

Financial Quotes for a Vision Board

Here are some powerful financial quotes that can keep you inspired as you work toward financial stability.

These words will help you stay focused and remind you why you’re putting in the effort:

- “The best way to predict your future is to create it.” – Abraham Lincoln

- “A budget is telling your money where to go instead of wondering where it went.” – Dave Ramsey

- “Money is only a tool. It will take you wherever you wish, but it will not replace you as the driver.” – Ayn Rand

- “By definition, saving – for anything – requires us not to get things now so we can get bigger ones later on.” – Jean Chatzky

- “Do not save what is left after spending, but spend what is left after saving.” – Warren Buffet

- “Once your money is in balance, you can stop worrying about it. Managing your money becomes automatic.” – Elizabeth Warren

- “Financial freedom is available to those who learn about it and work for it.” – Robert Kiyosaki

- “Beware of small expenses; a small leak will sink a great ship.” – Benjamin Franklin

- “The goal isn’t more money. The goal is living life on your terms.” – Chris Brogan

- “If you want to fly, you have to give up the things that weigh you down.” – Toni Morrison

- “They say it is better to be poor and happy than rich and miserable, but how about a compromise like moderately rich and just moody?” – Princess Diana

- “It’s not about how much money you make, it’s about how much money you keep.” – Robert Kiyosaki

- “If you think taking care of yourself is selfish, change your mind.” – Ann Richards

- “A penny saved is a penny earned.” – Benjamin Franklin

- “Financial freedom is the ability to live life on your terms.” – Suze Orman

- “It takes as much energy to wish as it does to plan.” – Eleanor Roosevelt

- “Setting goals is the first step in turning the invisible into the visible.” ― Tony Robbins

- “Used correctly, a budget doesn’t restrict you; it empowers you.” ― Tere Stouffer

These quotes can add the perfect motivational touch to your vision board!

Vision Board Examples (to Help You With Your Finance Stability)

Vision boards can be as unique as your financial goals.

Find what speaks to you—be it through images of a peaceful retirement, your future home, or symbols of financial freedom.

Your board is a reflection of where you want to go, so make it personal and inspiring.

Here are some financial board examples I made on Canva – which is an awesome way to make your vision board too!

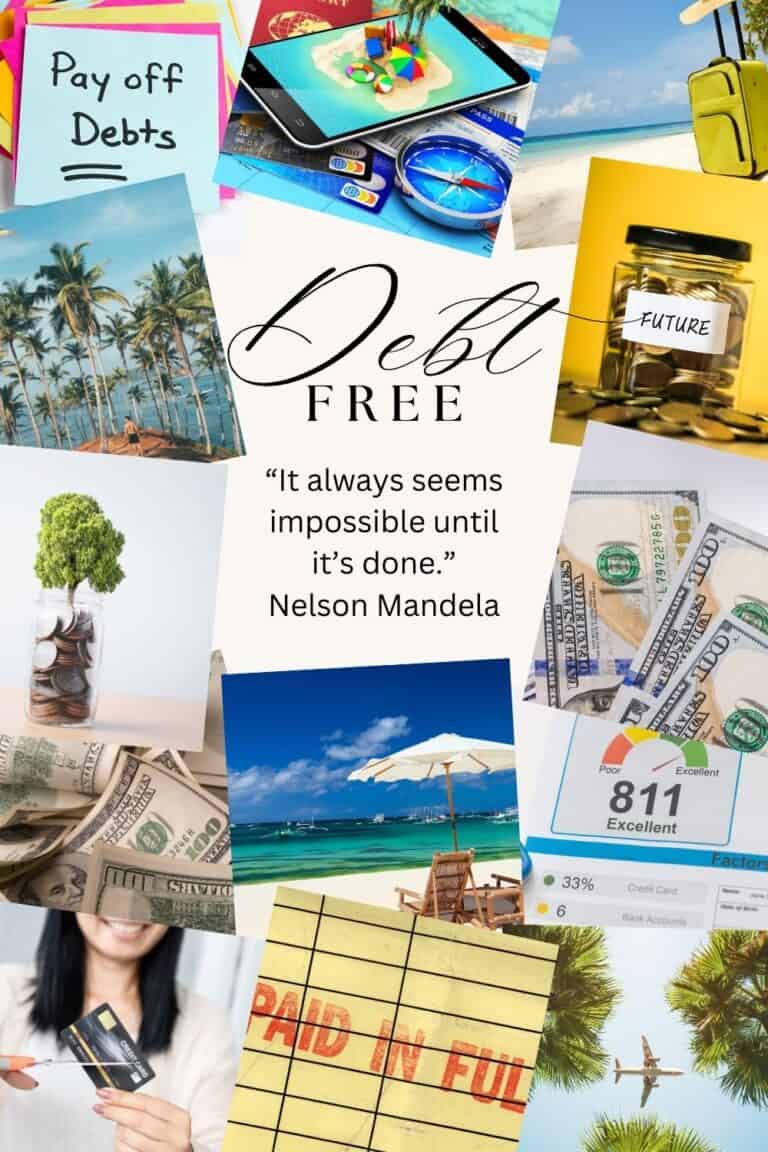

Debt-Free Dream Board

If getting rid of debt is your main goal, fill your board with images that represent financial freedom, like a “Paid in Full” stamp on bills or a clean credit report.

You could also include pictures of things that you’re working toward with the extra money you’ll save once you’re debt-free—maybe a vacation, a new home, or even a small emergency fund.

A great tip here is to use images that represent a debt-free lifestyle—think about the peace and freedom you’ll feel once you no longer have those monthly payments hanging over you.

Set realistic milestones like paying off one credit card or loan at a time, and celebrate each small win to stay motivated.

Wealth Building Vision

For this board, you’ll want to gather images of things that symbolize wealth—like a savings account growing, real estate properties, or stocks climbing.

Maybe include pictures of your dream house or a dream car to keep you focused on the big picture.

A good goal here is to establish a solid financial foundation with smart investments and saving consistently.

If you’re not sure where to start, add images of financial books, courses, or podcasts that can help you get educated.

Make sure to celebrate your progress, no matter how small, so you can see how far you’ve come on your journey to building wealth.

Family & Financial Harmony

This board is all about balancing your financial goals with family dreams.

You might want to add photos of a family vacation spot you’re saving for, a home you dream of buying, or images that represent the financial security you’re working toward for your loved ones.

Your goals here could include saving for a family emergency fund, building a college fund, or getting life insurance.

Include images that show the peace and happiness that financial security can bring, so you’re reminded that all of your hard work is ultimately for the well-being of your family.

Side Hustle & Extra Income

If growing your income through side hustles is your goal, fill your vision board with images of entrepreneurs you admire, freelance workspaces, or things you want to invest in (like a new laptop or equipment for your side gig).

Your goals here might include setting up a blog, creating an Etsy shop, or finding ways to turn your hobbies into cash.

To stay on track, try including images of people who’ve successfully made a living from their passions—they’ll inspire you to keep pushing.

Set monthly income goals for your side hustle and break them down into smaller weekly targets to stay motivated.

Emergency Fund & Safety Net

If building an emergency fund is your priority, include images of a full jar of money, a piggy bank, or pictures of feeling safe and secure.

The goal here is to get that cushion so you don’t have to worry about unexpected expenses.

Pictures of calm, worry-free moments can help keep you motivated—just imagining the peace of mind that comes with a solid emergency fund can make it easier to save.

Start with a small goal, like saving $1,000, and once you reach that, aim for 3-6 months of living expenses.

Add progress markers on your board to celebrate each step toward financial security.

Bring Your Financial Visions to Life

Creating a financial vision board isn’t just about putting pretty pictures on a board—it’s about setting intentions and bringing your financial goals into focus.

With the right images, quotes, and goals, your vision board can serve as a powerful tool to transform your financial future.

So, grab those magazines, print out some photos, and start building your own vision board—your financial dreams are waiting to be realized!