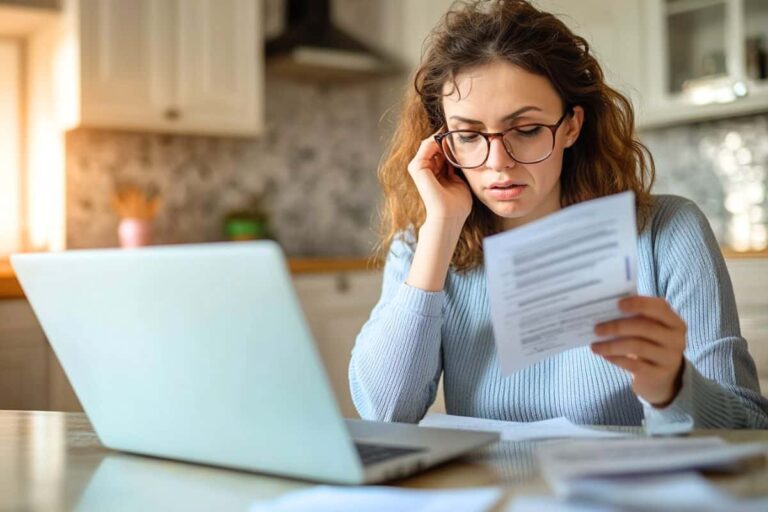

When I first became a mom, I was overwhelmed by the chaos of balancing household expenses and keeping our daily routines in check.

Every month felt like a juggling act, and the never-ending to-do lists only added to my stress.

I remember the day I sat down, determined to bring some order to our finances – especially since we went from a two household income to one income – and started piecing together a budget.

What began as a daunting task soon became a lifeline, transforming the way we managed our money and our time.

If you’re feeling lost in the whirlwind of budgeting, I’m here to share the step-by-step plan that turned our financial chaos into a manageable, even enjoyable, part of our lives.

How to Budget for Beginners

Starting a budget can feel overwhelming, especially when you’re juggling so many responsibilities – like saving for back to school supplies or birthday party gifts.

But with a little guidance, you’ll find that creating a budget is one of the most empowering steps you can take for your family’s financial well-being.

1. Understanding Your Income and Expenses

The first step in budgeting is getting a clear picture of where your money is coming from and where it’s going.

Start by listing all sources of income, including your partner’s, if applicable.

Then, track your expenses for a month, noting every single purchase, no matter how small.

This process will help you identify patterns and areas where you can potentially cut back and be a little frugal.

2. Setting Realistic Financial Goals

Setting financial goals is all about being practical and honest about what you can achieve.

Start with small, manageable goals like building a modest emergency fund or paying off a specific debt.

Make sure your goals are specific, measurable, and time-bound so you can track your progress.

Remember, it’s better to achieve small wins consistently than to set yourself up for disappointment with unrealistic expectations.

3. Choosing the Right Budgeting Method

Different budgeting methods work for different families, so it’s important to find one that fits your lifestyle.

The 50/30/20 rule is great if you prefer a simple structure, while zero-based budgeting gives you more control over every dollar.

Test out a method for a few months and see how it aligns with your financial goals and day-to-day routine.

Don’t be afraid to tweak or switch methods if something isn’t working.

4. Creating Your First Budget

Now that you’ve gathered all the information, it’s time to put together your first budget.

Start by listing your fixed expenses, like rent or mortgage, utilities, and groceries.

Then, allocate funds for variable expenses, such as entertainment and dining out, keeping them within your income limits.

Finally, set aside some money for savings and emergencies, even if it’s just a small amount to start with.

5. Staying on Track

Staying on track with your budget requires consistency and occasional adjustments.

Check in with your budget at least once a week to see how you’re doing and make any necessary tweaks.

If you overspend in one category, try to balance it out by cutting back in another.

Remember, the goal is progress, not perfection, so don’t be too hard on yourself if you hit a bump along the way.

Biweekly Savings Plan When You Have a Low Income

Saving money on a low income might seem impossible, but it’s all about making small, consistent changes that add up over time.

Even with limited resources, you can create a savings plan that helps you build a buffer for those unexpected expenses.

6. Maximizing Your Paychecks

When your income is limited, making the most of every paycheck is key.

Start by automating your savings, even if it’s just a small percentage, so you’re consistently putting money aside.

Next, prioritize paying down any high-interest debt to reduce financial strain.

Finally, look for opportunities to increase your income, whether through side gigs or asking for a raise.

7. Prioritizing Essential Expenses

When you’re working with a tight budget, it’s important to distinguish between needs and wants.

Focus on covering your essential expenses first, like housing, utilities, groceries, and transportation.

Anything left after those basics can be allocated towards debt repayment, savings, or discretionary spending.

This approach will make sure that your family’s core needs are always met, no matter how limited your income might be.

8. Creating a Savings Buffer

Building a savings buffer, even on a low income, is possible with a little planning.

Start small by setting aside a few dollars each week until you have at least $500 saved up for emergencies.

Over time, aim to grow this buffer to cover three to six months’ worth of essential expenses.

Having this cushion can provide peace of mind and protect your family from unexpected financial setbacks.

9. Finding Extra Savings Opportunities

Finding extra savings in a tight budget can seem challenging, but it’s doable with some creativity.

Consider meal planning to reduce grocery costs and minimize food waste. Look for discounts, coupons, or cashback apps that can help you save on everyday purchases.

You might also find savings by negotiating bills like your phone or internet service or by cutting out non-essential subscriptions.

10. Tracking and Adjusting Your Plan

Tracking your spending and adjusting your savings plan regularly is important to staying on course.

Use a budgeting app or a simple spreadsheet to monitor your expenses and see where your money is going.

At the end of each month, review your spending and make any necessary adjustments to your plan.

If you find you’re consistently overspending in one area, try reallocating funds from another category to keep your budget balanced.

Budget Planning Tips

Planning a budget doesn’t have to be stressful or time-consuming.

By following a few practical tips, you can create a plan that simplifies your finances and makes managing your money feel less daunting.

11. Budgeting Tools and Apps

Budgeting tools and apps can simplify the process and keep you organized.

Apps like Mint or YNAB can help you track spending, set goals, and receive alerts when you’re nearing your limits.

ome tools even link directly to your bank accounts, making it easier to monitor transactions in real-time.

Choose a tool that feels intuitive and matches your comfort level with technology, so it becomes a regular part of your routine.

12. Seasonal Budget Adjustments

Seasonal expenses can catch you off guard if you don’t plan for them in advance.

Whether it’s holiday gifts, back-to-school shopping, or summer activities, these costs can add up quickly.

To stay ahead, create a separate savings fund for these expenses and contribute to it throughout the year.

This way, when the season rolls around, you’ll have the money set aside without straining your regular budget.

13. Avoiding Common Budgeting Pitfalls

Common budgeting pitfalls can derail your financial progress if you’re not careful.

One of the biggest mistakes is underestimating expenses, so always round up when planning your budget.

Another pitfall is forgetting to budget for irregular expenses like car maintenance or medical bills.

To avoid these, take a look at your budget regularly and adjust as needed to cover unexpected costs.

14. Involving the Whole Family

Getting the whole family involved in budgeting can make the process smoother and more successful.

Start by having a family meeting to discuss your financial goals and how everyone can contribute.

Encourage older kids to track their own spending or save for something special.

When everyone is on the same page, it’s easier to stick to the budget and make financial decisions that benefit the entire household!

15. Regular Review and Adjustment

Regularly reviewing and adjusting your budget is key to long-term success.

Set a specific time each month to go over your finances and see how well you’ve stuck to your plan.

If you find that certain categories are consistently over or under budget, don’t be afraid to make changes.

Flexibility is important, as life and financial circumstances can change, requiring your budget to adapt accordingly.

Money Saving Challenges You Need to Jumpstart Your Budgeting

Sometimes, we all need a little push to get our finances in order!

A money-saving challenge can be just the motivation you need to kickstart your budgeting journey and start seeing real progress.

16. The 30-Day No-Spend Challenge

The 30-Day No-Spend Challenge is a powerful way to reset your spending habits.

For an entire month, commit to only spending on essentials like groceries, bills, and gas.

This challenge can help you identify unnecessary expenses and save more than you thought possible.

At the end of the month, take the money you saved and put it towards your financial goals, such as paying off debt or boosting your savings.

17. The $5 Savings Challenge

The $5 Savings Challenge is an easy and fun way to build up your savings over time.

Every time you receive a $5 bill, set it aside in a jar or separate bank account.

Over time, these small amounts can add up to a significant sum without feeling like a sacrifice.

This challenge is especially great for families, as even kids can get involved by saving their own $5 bills.

18. The 52-Week Savings Challenge

The 52-Week Savings Challenge helps you save a little more each week over the course of a year.

In the first week, save $1; in the second week, save $2, and so on until you’re saving $52 in the final week.

By the end of the year, you’ll have saved $1,378, which can be a nice boost to your emergency fund or used for a special purchase.

This challenge is flexible, so you can adjust the amounts to fit your budget.

19. Cash-Only Week Challenge

The Cash-Only Week Challenge is a great way to gain control over your spending habits.

For one week, commit to using only cash for all your purchases, leaving your cards at home.

This challenge forces you to think more carefully about your spending and prioritize what’s most important.

By the end of the week, you might be surprised at how much you saved by cutting out unnecessary expenses.

20. The Round-Up Savings Challenge

The Round-Up Savings Challenge turns your spare change into a valuable savings tool.

Every time you make a purchase, round up the total to the nearest dollar and transfer the difference into a savings account.

For example, if you spend $3.25, you’d round up to $4.00 and save the extra $0.75.

Over time, these small amounts can accumulate into a meaningful sum without requiring much effort.

Finding Balance in Your Financial Journey

Remember, budgeting and saving aren’t about perfection—they’re about progress.

It’s okay to take small steps and celebrate each win along the way.

You’re doing this for your family’s future, and with each mindful choice, you’re building a foundation of security and peace of mind.

Keep going, mama—you’ve got this!

For more money saving tips, follow me on Pinterest!