How can I live the most frugal life?

As a mom juggling family, work, and everything in between, I’ve often asked myself this question.

It’s not just about saving money but finding smart, creative ways to stretch every dollar while still enjoying life.

Grocery shopping hacks, DIY home projects, and simple lifestyle changes have shown me that living frugally doesn’t mean sacrificing quality or fun.

It’s about making mindful choices that benefit our family’s future without feeling like we’re constantly cutting corners.

Join me as I share my journey and favorite tips on living a fulfilling, frugal life that’s rich in experiences and savings.

Frugal Living 101

If you’re anything like me, being a new mom while keeping an eye on the budget is a top priority.

With the constant expenses of diapers, baby gear, and everything else that comes with having kids, it can feel overwhelming to manage it all.

I remember those sleepless nights not just because of the baby but also because I was worried about our finances.

That’s why I strived for a frugal living and it has been a game-changer. Living like this helps to ease that stress and make our family life more enjoyable.

Here are some frugal living tips that have made a huge difference for our family:

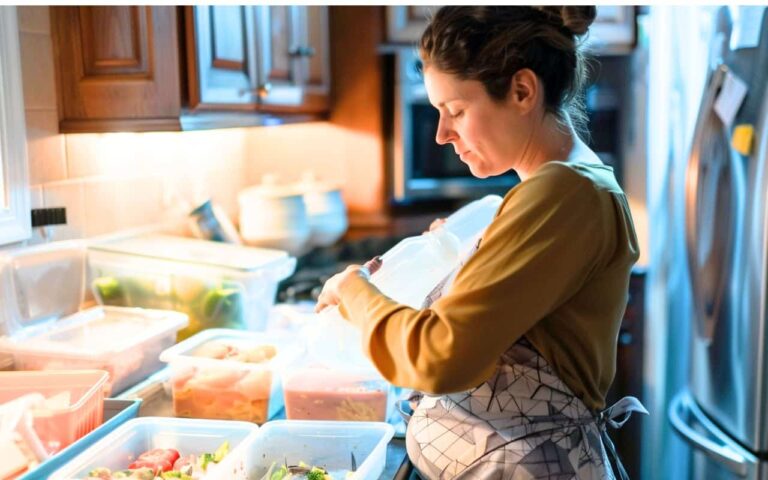

1. Meal Planning and Batch Cooking

One of the biggest money-savers is planning meals in advance. I spend a little time each week mapping out our meals and creating a shopping list. Cooking in batches and freezing meals saves time and reduces the temptation to order takeout on busy nights.

2. Cloth Diapers vs. Disposable

Cloth diapers can be a significant upfront investment but save loads in the long run. Plus, they’re environmentally friendly! If cloth isn’t for you, consider buying disposables in bulk during sales to save money.

3. Thrift Shopping for Baby Clothes and Gear

Babies grow so fast that their clothes and gear often look brand new when they outgrow them. Thrift stores, consignment shops, and online marketplaces are treasure troves for gently used baby items at a fraction of the cost.

4. DIY Baby Food

Making your own baby food is not only cost-effective but also healthier. Puree fruits, vegetables, and grains to create nutritious meals for your little one without breaking the bank.

5. Utilize Library Resources

Libraries are gold mines for free entertainment. Many offer story times, music classes, and other activities for kids. Plus, you can borrow books, movies, and educational toys without spending a dime.

6. Toy Swaps with Other Moms

Kids get bored with toys quickly. Organize a toy swap with other moms to keep playtime exciting without spending money. It’s a great way to get “new” toys and declutter at the same time.

7. Breastfeeding if Possible

If you can and choose to breastfeed, it’s a significant cost saver compared to formula. But if breastfeeding isn’t an option, look for sales, coupons, and bulk deals on formula.

8. Homemade Cleaning Products

Baby-safe, homemade cleaning products are easy to make and much cheaper than store-bought ones. Simple ingredients like vinegar, baking soda, and essential oils can handle most cleaning tasks around the house.

9. Energy Savings at Home

Small changes can lead to big savings on utility bills. Use energy-efficient light bulbs, unplug appliances when not in use, and keep the thermostat at an energy-saving temperature.

10. Entertainment on a Budget

Look for free or low-cost family activities in your community. Parks, playgrounds, community events, and nature trails provide hours of fun without the expense.

Living frugally as a new mom is all about finding balance and making smart choices.

It’s about creating a comfortable, happy home for your family without stressing over finances.

Remember, every small step adds up to big savings over time. You’ve got this, mama!

How to Save Money on a Low Income

When I first became a mom, I was overwhelmed by how quickly baby expenses added up, and I had to get creative to make ends meet.

Through trial and error, I discovered some effective ways to save money, and I can’t wait to share those tips with you.

11. Join Local Parenting Groups

Many local parenting groups have resource-sharing programs where you can borrow or exchange baby gear and clothes. These groups are also great for getting advice and finding out about free local events for kids.

12. Participate in Free Community Events

Libraries, community centers, and local parks often host free activities and events for families. These can be great opportunities for entertainment and socialization without spending a dime.

13. Use Cashback and Rewards Apps

There are several apps that offer cashback or rewards for purchases you’re already making. Apps like Rakuten, Ibotta, and Fetch Rewards can help you earn money back on groceries and other essentials.

Using cashback and rewards apps has been crucial for me.

Those apps have helped me earn money back on groceries and other essentials, making it so much easier to manage our budget and stretch every dollar further.

14. DIY Baby Items

Get crafty and make your own baby items like bibs, burp cloths, and simple toys. There are plenty of online tutorials and patterns that can help you create useful items from inexpensive materials.

15. Buy in Bulk and Share

Purchase items like diapers, wipes, and baby food in bulk to save money. If buying in bulk is too much for your budget, consider teaming up with another mom to split the cost and share the items.

I began purchasing items like diapers, wipes, and baby food in bulk to save money.

When buying in bulk was too much for my budget, I teamed up with another mom to split the cost and share the items, making it more affordable for both of us.

16. Couponing and Discount Codes

Take advantage of coupons and discount codes whenever possible. Websites like Honey and RetailMeNot can help you find the best deals and discounts for your purchases.

17. Utilize Government Programs

Look into programs like WIC (Women, Infants, and Children) which provide financial assistance for healthy food, breastfeeding support, and other resources for low-income families.

18. Opt for Multi-Functional Furniture

Invest in furniture that grows with your child, like cribs that convert into toddler beds and changing tables that can be used as dressers later. This way, you make a one-time purchase that serves multiple purposes over the years.

19. Create a Baby Budget

Track your expenses and create a budget specifically for baby-related costs. This helps you stay on top of your spending and identify areas where you can cut back or save more effectively.

20. Meal Sharing with Other Families

Organize meal-sharing with other families in your community. Take turns cooking large batches of food and sharing, which can save time and money while also providing variety in meals.

I started organizing meal-sharing with other families in our community. We take turns cooking large batches of food and sharing, which has saved us time and money while also providing a great variety of meals for our families.

Being a new mom on a low income requires some strategic planning, but these tips have helped me manage our budget while ensuring my baby has everything they need. Remember, every little bit helps, and small changes can add up to significant savings over time.

Money Saving Techniques

To save money, I started a small vegetable garden in our backyard, growing carrots, peas, and tomatoes, which drastically cut down our grocery bills and provided fresh, organic produce for my baby’s meals.

Organizing baby clothes swapping parties with other moms in the neighborhood was a fun and free way to refresh my baby’s wardrobe, and it quickly became a community favorite.

21. Cloth Baby Wipes

I started using cloth baby wipes instead of disposable ones. I made them from old, soft T-shirts and used a homemade solution of water, baby soap, and a few drops of essential oil. This saved me money and was gentler on my baby’s skin.

22. Homemade Baby Toys

I began crafting simple toys at home using household items. One of my baby’s favorites is a sensory bottle made from an old plastic bottle filled with rice and colorful beads. It’s amazing how entertained they can be with something so simple and inexpensive.

23. Growing a Small Vegetable Garden

I started a small vegetable garden in our backyard. Growing my own veggies like carrots, peas, and tomatoes not only cut down our grocery bills but also provided fresh, organic produce for my baby’s meals.

23. Baby Clothes Swapping Parties

I organized baby clothes swapping parties with other moms in my neighborhood. We all brought gently used baby clothes that our little ones had outgrown and swapped them. It was a fun way to refresh my baby’s wardrobe without spending any money.

24. DIY Babyproofing

Instead of buying expensive babyproofing kits, I used affordable alternatives. Pool noodles cut in half were perfect for covering sharp edges, and rubber bands kept cabinets closed. This approach was much easier on the wallet and just as effective.

Financial Life Hacks

Setting up automatic savings transfers every payday helped me build up our emergency fund effortlessly.

Mastering coupon stacking and using online price alerts for baby gear allowed me to get the best deals, making our budget go much further.

25. Automatic Savings Transfers

I set up automatic transfers to my savings account every payday, even if it’s just a small amount. This helped build our emergency fund without having to think about it, and those small amounts really add up over time.

26. Online Shopping Price Alerts

Using apps that alert me when the price drops on items I need has saved me so much money. I set alerts for baby gear and essentials, ensuring I get the best deals without constantly searching for sales.

27. Cashback on Utilities

I discovered that some credit cards offer cashback on utility payments. I started paying our electricity and internet bills with a cashback card and used the rewards to buy baby supplies.

28. Buying Off-Season

I started buying baby clothes and gear off-season. Winter coats in spring and summer clothes in fall are often heavily discounted, which helped me save a lot.

29. Coupon Stacking

I became a pro at stacking coupons with sales and cashback offers. Combining these discounts on baby products and groceries maximized our savings, making our budget stretch further.

30. Energy-Efficient Home

Making our home more energy-efficient was a long-term money saver. Simple changes like using LED bulbs, weather-stripping doors, and installing a programmable thermostat reduced our utility bills significantly.

31. Bulk Cooking and Freezing

I began cooking in bulk and freezing meals, which saved both time and money. It allowed me to buy ingredients in larger, cheaper quantities and ensured we always had homemade meals ready, reducing the temptation to spend on takeout.

20 More Frugal Living Ideas for Everyone

Now if you want some more frugal living ideas, here are some for everyone that might be struggling.

- Use a Budgeting App: Track your expenses and identify areas where you can cut back. My fav is YNAB app.

- Buy Generic Brands: Opt for store brands instead of name brands for groceries and household items.

- Cancel Unused Subscriptions: Review and cancel any subscriptions you no longer use or need.

- Carpool or Use Public Transportation: Save on gas and reduce wear and tear on your vehicle.

- Repair Instead of Replace: Fix broken items instead of buying new ones.

- Make Coffee at Home: Skip the expensive coffee shop and brew your own coffee.

- Grow Your Own Herbs: Start a small herb garden to save money on fresh herbs.

- Use Cashback and Rewards Credit Cards: Earn rewards on everyday purchases.

- Negotiate Bills: Call service providers to negotiate lower rates on bills like cable, internet, and insurance.

- Shop Secondhand: Buy clothes, furniture, and other items from thrift stores or online marketplaces.

- DIY Gifts: Make personalized gifts instead of buying expensive presents.

- Use Cloth Instead of Paper: Replace paper towels and napkins with reusable cloth alternatives.

- Cook at Home: Prepare meals at home instead of dining out.

- Make a Meal Plan: Plan meals for the week to avoid last-minute takeout orders.

- Buy in Bulk: Purchase non-perishable items in bulk to save money over time.

- Limit Impulse Purchases: Wait 24 hours before making any unplanned purchases.

- Use Energy-Efficient Appliances: Upgrade to energy-efficient appliances to reduce utility bills.

- Unplug Electronics: Unplug devices when not in use to save on electricity.

- Find Free Entertainment: Explore free activities in your community like parks, museums, and events.

- Practice Minimalism: Declutter your home and focus on buying only what you truly need.

Disadvantages to Frugal Living

Are there any disadvantageous to being frugal?

While being frugal has many benefits, it’s not without its challenges.

For starters, it can be time-consuming.

Clipping coupons, shopping around for the best deals, and planning meals in advance all require a significant amount of effort and organization. Sometimes, it feels like a part-time job just to save a few extra dollars.

Another downside is the potential for missing out on experiences. Saying no to social events or activities because they don’t fit within the budget can lead to feelings of isolation or missing out on important moments with friends and family. It’s a delicate balance to maintain social connections without overspending.

Additionally, there’s the risk of buying lower-quality items. In the quest to save money, I’ve occasionally purchased cheaper products that didn’t last as long, ultimately costing more in the long run.

It’s a constant learning curve to find that sweet spot between cost and quality.

Lastly, the mental and emotional strain can’t be overlooked.

Constantly worrying about money and making ends meet can be stressful and exhausting. It requires a lot of mental energy to stay on top of finances and make frugal choices consistently.

Despite these disadvantages, the overall benefits of frugal living—like financial stability and reduced stress about money—make it worthwhile for me.

It’s all about finding a balance and remembering that it’s okay to splurge occasionally for the sake of happiness and well-being.

I hope this helped!

Please Pin me!