Becoming debt free might feel like a dream, especially when it feels like there’s no money left after paying bills.

Trust me, you’re not alone in feeling overwhelmed by finances—it’s something many of us are dealing with.

But the key to turning things around isn’t about sudden, massive changes.

It’s about building small, practical habits that actually stick!

Budgeting might sound boring or restrictive, but it’s really just a way to take control instead of feeling controlled.

You don’t need to be a finance expert or have a big paycheck to start making progress.

Small steps can make a huge difference.

Let’s get into some simple, realistic habits that can help you finally say goodbye to debt for good!

Your Debt Free Plan

If you’re ready to kick your debt to the curb, this debt free plan will help you turn things around!

By doing things like tracking your spending and creating a budget that works for you, freedom from debt is closer than you think.

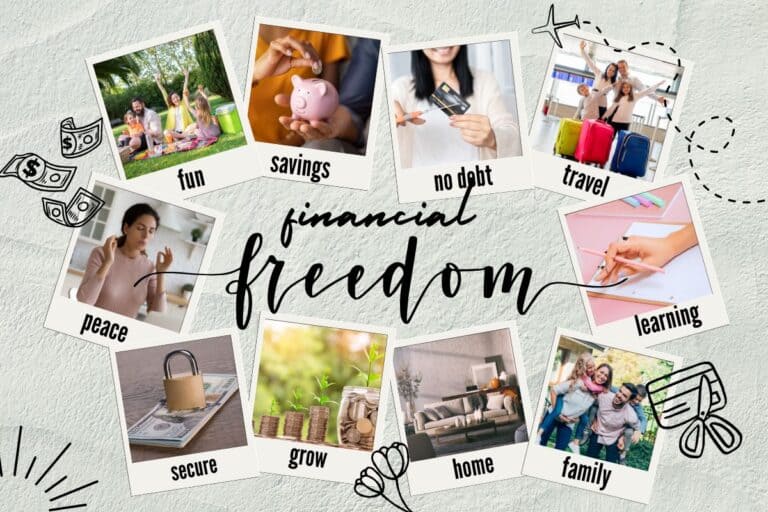

1. Create a Debt-Free Vision Board

Let’s start with something fun and inspiring: a vision board.

Yes, this might sound a little arts-and-crafts, but stick with me—it works!

Grab a poster board or go digital with a Pinterest board, and fill it with images, words, and quotes that represent what being debt-free looks like for you.

Maybe it’s a picture of a paid-off credit card, a dream vacation, or just the word “freedom” in bold letters.

I made mine on a random Saturday morning with coffee in hand and good old Canva!

Seeing those goals every day kept me going, especially on tough budgeting weeks when I wanted to splurge.

Keep it somewhere visible, like on your fridge or as your phone wallpaper.

It’s a simple way to remind yourself why you’re putting in the work and to stay excited about the future you’re building.

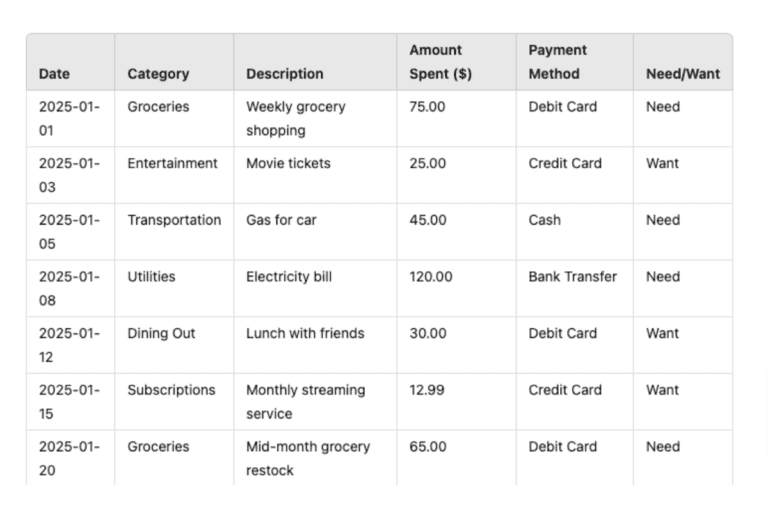

2. Track All Your Expenses for a Month

Tracking your expenses is the step where everything clicks.

For one month, write down every single dollar you spend—yes, every single one.

You can use an app, a spreadsheet, or even just the notes app on your phone.

This step is about being honest with yourself and getting a clear picture of where your money is going.

Maybe you notice you’re overspending on small things, like daily snacks, or subscriptions you forgot about.

You might even find areas where you can cut back without feeling the pinch.

By the end of the month, you’ll have a solid understanding of your spending habits and where you can redirect money toward paying off debt.

3. Set a Realistic Budget

A budget is simply a plan for your money, and the key word here is “realistic.”

Start by listing your income, then subtract all your fixed expenses, like rent, groceries, and utilities.

Whatever’s left can be divided between debt payments, savings, and fun spending.

The trick is to be honest with yourself.

If you know you’re going to want coffee a few times a week, budget for it instead of pretending you won’t spend it.

That was a mistake I made early on—I cut out all fun spending and felt miserable two weeks later.

Instead, build a budget you can stick to!

Review it every month and make adjustments as needed because life happens.

The goal isn’t perfection – it’s progress!

4. Check Your Bank Accounts Daily

This is a habit that completely changed the way I handled my finances.

Every morning, I started checking my bank accounts while sipping my coffee.

It became a quick five-minute ritual to see what came in, what went out, and how much was left.

At first, I was nervous—let’s be real, it’s easy to ignore your balance and hope for the best.

But after a few weeks, it felt empowering to know exactly where I stood.

This small daily habit kept me from overspending and made sure I didn’t miss anything important, like bills or fraud alerts.

It’s like a little accountability check with yourself every day, and it works.

5. Prioritize Your Debts

If you’ve got multiple debts, it’s time to make a plan to tackle them.

Start by listing them all out—yes, even the small ones you think don’t matter.

You can either prioritize by smallest balance (debt snowball) or highest interest rate (debt avalanche).

Both methods work, so choose what feels best for you.

If paying off smaller debts first will give you a mental boost, go for it.

The key is to have a clear focus.

Start with one, pay as much as you can toward it while making minimum payments on the others, and then move on to the next.

6. Start a Debt Snowball or Avalanche Plan

When I first heard about the debt snowball plan, I wasn’t sure it would make a difference, but let me tell you—it’s a game-changer!

I started by listing my debts from smallest to largest and attacking the smallest one first.

Every time I paid one off, I rolled the payment amount into the next debt, and the momentum was incredible.

Seeing those “paid in full” notices felt amazing.

If you’re more motivated by saving on interest, the avalanche method (starting with the highest interest rate) works just as well.

Choose what motivates you, and don’t underestimate the power of those small wins.

7. Build a Small Emergency Fund

This step was a lifesaver for me.

Setting aside $500–$1,000 as an emergency fund helped me avoid taking on new debt when unexpected expenses popped up.

I remember a month where my car battery died, and because I had my emergency fund, I didn’t have to reach for a credit card.

Start small, even if it’s $10 a week.

Keep the money in a separate account so you’re not tempted to dip into it for non-emergencies.

Having that cushion gives you peace of mind and helps you stay on track with your debt payoff plan.

8. Celebrate Small Milestones

Paying off debt can feel like a long journey, so it’s important to celebrate your wins along the way.

Did you pay off a credit card or hit a savings goal?

Treat yourself—within reason!

Maybe it’s a fancy coffee, a night in with your favorite movie, or something simple you’ve been eyeing.

These small celebrations keep you motivated and remind you that progress is worth recognizing.

Just don’t celebrate by swiping a card. Keep it budget-friendly!

9. Set Monthly Financial Check-Ins

I didn’t realize how helpful monthly financial check-ins would be until I started doing them.

Once a month, I sit down with my budget, expenses, and goals to see how things are going.

The first couple of check-ins were a little rough—sometimes I overspent, or things didn’t go as planned—but they got easier and more rewarding over time.

I use this time to adjust my budget, set new goals, and even look ahead to upcoming expenses.

It’s like a mini date with your finances, and it helps you stay in control and focused.

10. Learn One New Personal Finance Tip Monthly

Building financial knowledge doesn’t have to be overwhelming.

Commit to learning one new tip or strategy each month.

Maybe you read a personal finance book, listen to a podcast, or follow a budgeting expert online.

Over time, these small bits of knowledge add up and can lead to big changes.

Plus, it’s empowering to feel like you’re growing your skills while working toward your goals!

Pick something that interests you and fits your journey, and keep building that confidence.

You’ve Got This—Time to Take Control of Your Debt!

Becoming debt-free isn’t a sprint, it’s a marathon—and you’ve already got the tools to cross that finish line!

By building simple habits and staying consistent, you’ll make progress that adds up over time.

You’ve got what it takes, and with each step, you’re closer to financial freedom!

For more budgeting advice, make sure to follow me on Pinterest!